Let's face it - tax calculations can be tedious. But what if I told you Excel could handle the heavy lifting? As someone who's crunched numbers for countless financial reports, I've discovered some game-changing techniques that'll save you hours of manual work.

Understanding the Basics

At its core, tax calculation is simple math: base amount × tax rate = tax amount. But when you're dealing with dozens or hundreds of items, manual calculations become error-prone. That's where Excel shines.

Take this common scenario:

- Product price: $100

- Tax rate: 8%

- Total price: $108

Simple, right? Now imagine doing this for 500 products with varying rates. Suddenly, manual math doesn't seem so appealing.

Setting Up Your Tax Calculator

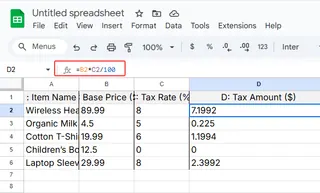

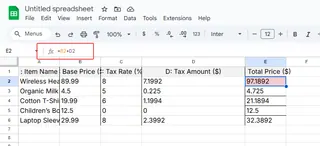

Here's how I structure my tax calculation sheets:

Create columns for:

- Item name (A)

- Base price (B)

- Tax rate (C)

- Tax amount (D)

- Total price (E)

For the tax amount column, use:

=B2*C2

- For total price:

=B2+D2

Pro tip: Double-click the fill handle to automatically apply formulas to your entire dataset. No more dragging required!

Handling Multiple Tax Rates

Real-world scenarios are rarely simple. Different products often have different tax rates. Here's how I manage this complexity:

Option 1: Manual entry (fine for small datasets)

- Simply enter each item's specific rate in column C

Option 2: VLOOKUP magic (perfect for larger datasets)

- Create a reference table with product categories and their rates

- Use:

=VLOOKUP(A2, TaxRatesTable, 2, FALSE)

This automatically pulls the correct rate for each item. No more scrolling through rate sheets!

Level Up With Excelmatic

While these Excel techniques work, they still require manual setup. That's where Excelmatic changes the game. Our AI-powered platform can:

- Automatically detect tax rates based on product categories

- Generate complete tax reports with one click

- Update calculations instantly when rates change

Imagine uploading your product list and getting fully calculated tax amounts in seconds. That's the power of AI-driven automation.

Common Pitfalls to Avoid

Even seasoned Excel users make these mistakes:

- Forgetting to lock cell references with

$when copying formulas - Using unrounded amounts (always use

=ROUND(B2*C2, 2)) - Not updating rates when tax laws change

Excelmatic eliminates these risks by maintaining always-up-to-date rate databases and applying proper rounding automatically.

Advanced Techniques

Ready to take your tax game to the next level? Try these:

- Conditional formatting to highlight items with special tax status

- Data validation dropdowns for consistent rate selection

- Pivot tables for quick tax liability summaries

But here's the real pro tip: Excelmatic can generate all these advanced reports automatically, complete with visualizations and trend analysis.

The Future of Tax Calculations

Manual tax calculations belong in the past. With tools like Excelmatic, you can:

- Reduce errors by 90%

- Cut processing time by 80%

- Generate audit-ready reports instantly

Why spend hours on spreadsheets when AI can do it better, faster, and more accurately? Give Excelmatic a try today and experience the future of financial automation.

Remember: Whether you stick with native Excel or upgrade to AI-powered solutions, the key is working smarter, not harder. Your future self will thank you when tax season rolls around!