Key takeaways:

- Traditional Excel What-If Analysis tools like Goal Seek, Scenario Manager, and Data Tables are powerful for financial modeling but are often rigid, complex, and time-consuming to configure.

- An Excel AI agent like Excelmatic revolutionizes this process by allowing you to perform sensitivity and scenario analysis using a conversational chat interface, eliminating manual setup.

- By simply asking questions in natural language, you can instantly run goal-seek calculations, compare multiple scenarios, and generate data tables, dramatically improving your efficiency and analytical flexibility.

The Challenge: Exploring "What Ifs" in Your Business Data

Have you ever found yourself tweaking numbers in a spreadsheet, trying to predict an outcome? "What if we increase our marketing budget by 15%? How will that affect our net profit?" or "If we need to hit a $1.2 million revenue target, how many units must we sell at our current price point?"

This process is called What-If Analysis or sensitivity analysis. It's a cornerstone of financial planning, business forecasting, and strategic decision-making. Whether you're modeling a personal loan, projecting company revenue, or creating a budget, the ability to explore different scenarios is crucial.

Excel has built-in tools for this, but many users find them frustrating. You might have a perfectly good financial model, but the moment your boss asks, "Can you show me the numbers for a few different interest rates and loan terms?", you feel a sense of dread. You know you're in for a tedious session with clunky dialog boxes, trying to remember the difference between Goal Seek, Scenario Manager, and Data Tables. It's slow, error-prone, and kills the momentum of your analysis.

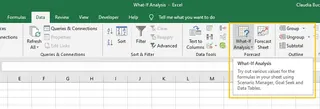

The Traditional Excel Way: Steps and Limitations

For decades, Excel has offered a suite of tools under the "What-If Analysis" menu on the Data tab. Let's briefly review them and their inherent challenges, using a common loan calculation model as an example.

Imagine a simple model where you calculate the Monthly Payment based on three inputs: Loan Amount, Interest Rate, and Loan Term (Months).

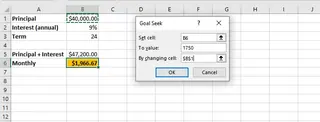

1. Goal Seek: Working Backwards (With a Catch)

Goal Seek is designed to solve for a single input when you know the desired output.

- Scenario: You know you can only afford a monthly payment of $1,750. You want to find out the maximum

Loan Amountyou can borrow. - Process: You open Goal Seek, set the

Monthly Paymentcell to the value$1750by changing theLoan Amountcell. - Limitations:

- One Variable Only: It can only solve for one input at a time. You can't ask it to adjust both the loan amount and the term simultaneously.

- Destructive: When you click "OK," Goal Seek permanently changes the value in your input cell. If you want to go back, you have to remember to hit Undo (Ctrl+Z). This makes comparing options difficult.

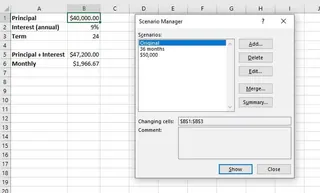

2. Scenario Manager: Comparing Scenarios (Clumsily)

Scenario Manager lets you save and compare different sets of input values.

- Scenario: You want to compare three options: a "Base Case" ($40k loan for 24 months), a "Longer Term" option ($40k for 36 months), and an "Aggressive" option ($50k for 36 months).

- Process: You manually open Scenario Manager, click "Add" for each scenario, give it a name, and type in the new values for your input cells. Finally, you generate a static "Scenario Summary" report on a new worksheet.

- Limitations:

- Tedious Setup: The interface involves multiple pop-up windows and requires you to define changing cells and result cells manually. It's not intuitive.

- Static Output: The summary report is a snapshot in time. If you update your original model's formulas, the report does not update. You have to generate a new one.

- Poor Readability: The default summary report is often poorly formatted and hard to read without significant cleanup.

3. Data Tables: The Power and the Pain

Data Tables are great for seeing how one or two variables impact a result across a range of values.

- Scenario: You want to see how the

Monthly Paymentchanges for loan amounts from $30k to $50k (in $5k increments) and for loan terms of 24, 36, and 48 months. - Process: This is the most complex to set up. You have to structure a table with one variable's values in a column, the other in a row, link your result formula in the corner, select the entire range, and then correctly identify the "Row input cell" and "Column input cell" in the Data Table dialog.

- Limitations:

- Steep Learning Curve: The setup is notoriously confusing for most users. One wrong reference and the whole table fails.

- Rigid Structure: It's limited to one or two variables. If you want to add a third variable (e.g., different interest rates), you can't.

- Not Interactive: The table shows results, but it doesn't explain them. You can't easily "drill down" or ask follow-up questions about the results.

The New Way: Using an Excel AI Agent (Excelmatic)

What if you could skip all those dialog boxes and just... ask? This is the promise of Excel AI agents like Excelmatic. Instead of forcing you to learn a rigid tool, it lets you have a conversation about your data.

Here’s how you'd solve the exact same problems using Excelmatic's conversational approach.

Step 1: Upload Your Excel Model

First, you upload your Excel file containing the loan calculator model to Excelmatic. The AI instantly parses your data, formulas, and headers, understanding the relationships between your inputs and outputs.

Step 2: Ask "What If" Questions in Plain Language

Now, instead of navigating menus, you simply type your questions into the chat interface.

To replicate Goal Seek:

My monthly payment can't be more than $1,750. What is the maximum loan amount I can get, assuming a 9% interest rate and a 24-month term?

To replicate Scenario Manager:

Create a table that compares the monthly payment and total interest paid for these three scenarios:

- Loan: $40,000, Term: 24 months

- Loan: $40,000, Term: 36 months

- Loan: $50,000, Term: 36 months

To replicate a Data Table:

Generate a data table showing the monthly payment. For the rows, use loan amounts from $30,000 to $50,000 in steps of $5,000. For the columns, use loan terms of 24, 36, and 48 months. The interest rate is 9%.

Step 3: Iterate and Explore in Real-Time

This is where the AI approach truly shines. Traditional tools give you a static answer. An AI agent invites a conversation.

You can ask follow-up questions to refine your analysis on the fly:

- "Okay, in that last table, highlight all the options where the monthly payment is under $1,500."

- "Now add a new column to the scenario comparison showing the total interest paid as a percentage of the loan amount."

- "Which of these options gives me the lowest total interest paid?"

Step 4: Export Your Results

Once you have the analysis you need—whether it's a single number, a comparison table, or a full data matrix—you can instantly download it as a new, clean Excel file to share with your team or include in a report.

A Sample Conversation with Excelmatic

Here’s what that workflow might look like in practice:

You: I've uploaded my loan model. If I take a $40,000 loan at 9% over 24 months, what's my monthly payment?

Excelmatic: Based on your model, the monthly payment would be $1,825.97.

You: That's a bit high. What's the maximum I can borrow if I want to keep my monthly payment at exactly $1,750, with the same rate and term?

Excelmatic: To achieve a monthly payment of $1,750, you could borrow a maximum of $38,336.14. I have updated the table to show this calculation.

You: Great. Now, create a table comparing the monthly payments for loan amounts of $35k, $40k, and $45k, across terms of 24, 36, and 48 months.

Excelmatic: Of course. Here is a data table showing the monthly payment for each combination of loan amount and term.

| Loan Amount | 24 Months | 36 Months | 48 Months |

|---|---|---|---|

| $35,000 | $1,597.72 | $1,112.59 | $886.41 |

| $40,000 | $1,825.97 | $1,271.53 | $1,013.04 |

| $45,000 | $2,054.21 | $1,430.47 | $1,139.67 |

You: Perfect. Please export this table to a new Excel file.

Traditional Tools vs. Excelmatic: A Quick Comparison

| Feature | Traditional Excel (Goal Seek, etc.) | Excelmatic (Excel AI) |

|---|---|---|

| Learning Curve | High; requires learning specific tools and dialogs. | Low; based on natural language conversation. |

| Flexibility | Rigid; limited to 1-2 variables, hard to ask follow-ups. | High; easily explore multiple variables and iterate. |

| Speed | Slow; manual setup for each scenario and report. | Instant; get answers and tables in seconds. |

| Process | Disjointed; requires multiple tools and generates static reports. | Fluid; a single conversational flow from question to answer. |

FAQ

Q: Do I still need to build the initial formulas in my Excel file? A: Yes. Excelmatic works by analyzing your existing model. You need to have the core formulas (like the PMT function for a loan) in place. The AI then uses that logic to run the scenarios you ask for, saving you from the manual analysis steps.

Q: Is my financial data safe when I upload it to Excelmatic? A: Data security is a top priority. Excelmatic uses enterprise-grade security protocols and does not store your file contents after your session ends. For specific details, always refer to the official privacy policy on the website.

Q: Can Excelmatic handle complex financial models beyond a simple loan calculator? A: Absolutely. As long as your model's inputs and outputs are connected by Excel formulas, the AI can perform what-if analysis on complex profit & loss statements, sales forecasts, inventory models, and more.

Q: Is this for beginners or advanced Excel users? A: It's for both. Beginners can get answers without needing to learn complex functions. Advanced users can dramatically speed up their analytical workflow, saving hours of tedious work and focusing more on strategic insights.

Take Action: Upgrade Your Excel Workflow Today

Stop letting clunky tools slow you down. The time you spend wrestling with Scenario Manager or setting up Data Tables is time you could be spending on higher-value analysis and strategic thinking.

An Excel AI agent like Excelmatic acts as your personal data analyst, ready to explore any "what-if" question you can think of. It transforms a tedious, multi-step process into a simple, interactive conversation.

Ready to see the difference? Try Excelmatic for free. Upload one of your own financial models or budget spreadsheets and try asking it one of the questions from this guide. Experience the future of spreadsheet analysis for yourself.