Key takeaways:

- Building a custom Excel calculator for tasks like insurance premiums often requires complex, nested

VLOOKUPorINDEX/MATCHformulas that are difficult to create, manage, and are highly prone to errors. - Excel AI tools like Excelmatic replace these manual formulas entirely. You can simply upload your data and ask in plain English to "calculate the premium based on these building factors," and the AI handles all the lookups and calculations.

- Using Excelmatic not only saves hours in setup time but also eliminates formula errors and empowers any team member to get instant quotes by changing inputs, without needing to understand the complex underlying logic.

The Challenge: Creating a Fast and Accurate Quoting Tool

Imagine you're an insurance agent or a financial analyst. A core part of your job is providing clients with quick, accurate quotes for products like property insurance. These quotes aren't simple; they depend on a multitude of factors. For a building, this could include its age, construction material, the condition of its roof, plumbing, and electrical systems.

You have all the data: rate tables that specify how each factor affects the final premium. The problem is, manually cross-referencing these tables for every single quote is incredibly time-consuming and a recipe for human error. A single wrong lookup could lead to a misquote, damaging client trust and potentially costing your company money.

The natural next step for many is to build a "calculator" in Excel. You envision a simple dashboard where you can plug in the property's details and have the annual premium pop out instantly. While this is a great idea, the execution in traditional Excel can quickly become a technical nightmare.

The Traditional Excel Solution: A Maze of Formulas

The standard approach to building this calculator involves a combination of data validation, lookup functions, and arithmetic formulas. It’s a powerful method, but it comes with significant baggage.

Let's break down the typical manual process.

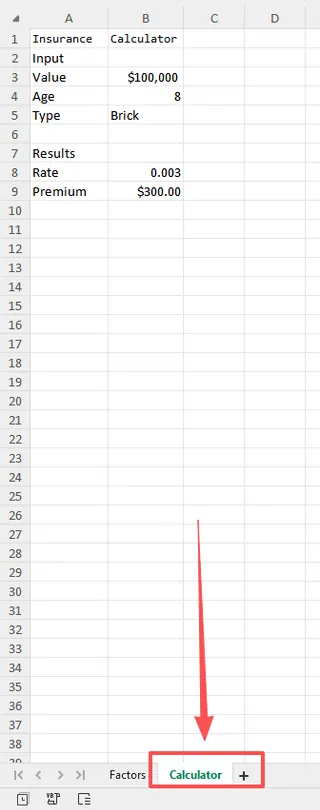

You'd start with your data organized on two sheets:

- Calculator Sheet: An input area where you enter the building's value and select various attributes from dropdown lists.

- Factors Sheet: This sheet contains your "rate tables"—the source of truth. For example, one table might hold rates based on building age and construction type, while another holds rates for finishing details like plumbing and heating.

The Step-by-Step Manual Build

- Create Dropdown Lists: To prevent typos, you'd use Excel's Data Validation feature to create dropdown menus for each input factor (e.g., Construction Type, Roof Age) on your

Calculatorsheet. This ensures the user can only select valid options from yourFactorstables.

Write Complex Lookup Formulas: This is where the real headache begins. For each factor selected in the input area, you need to pull the corresponding rate from the

Factorssheet. A simpleVLOOKUPoften isn't enough, especially if you need to look up a value based on both a row and a column header (a two-way lookup). You'll likely need to use a more robust but complex combination likeINDEXandMATCH.For a single factor, the formula might look something like this:

=INDEX(RateTable, MATCH(SelectedFactor, FactorColumn, 0), MATCH(Category, CategoryRow, 0))

Now, imagine having to write, debug, and chain together 5 to 10 of these formulas, one for each input factor.

- Calculate the Final Premium: Once you've successfully pulled all the individual rating factors, you need to sum them up and multiply them by the building's total value to arrive at the final annual premium. This last step is simple, but it's entirely dependent on the accuracy of the preceding lookup formulas.

The Limitations of the Manual Approach

While a functional calculator is the end result, this traditional path is fraught with challenges:

- High Complexity:

INDEX/MATCHformulas are powerful but are not intuitive for the average Excel user. They are hard to write correctly and even harder for a colleague to decipher later. - Error-Prone: A misplaced comma, an incorrect range reference, or a slight change in a table's structure can break the entire calculator. Debugging these formulas can take hours.

- Difficult to Maintain: What happens when your company updates its rating tables or adds a new factor (e.g., "Seismic Retrofitting")? You have to dive back into the formula maze, carefully updating ranges and logic, and hoping you don't break something else in the process.

- Lack of Flexibility: The calculator is rigid. It can answer "what is the premium for X," but it can't easily answer more analytical questions like, "Which factor has the biggest impact on the premium?" or "Show me a comparison of premiums for Frame vs. Masonry construction."

The New Solution: Using an Excel AI Agent (Excelmatic)

Instead of building a fragile web of formulas, what if you could just describe the logic of your calculator in plain language and have an AI do the heavy lifting? That's exactly what Excel AI agents like Excelmatic are designed for.

Excelmatic allows you to upload your data file and use a chat interface to request analysis, formulas, and reports. It understands the structure of your data and can perform the complex lookups and calculations for you, instantly.

Step-by-Step Guide with Excelmatic

Let's rebuild our insurance premium calculator using Excelmatic. The process is dramatically simpler.

1. Upload Your Data File

First, take your Excel file—the one containing both the Calculator input sheet and the Factors sheet—and upload it directly to Excelmatic. The AI will parse the data, recognizing the tables and their headers.

2. Describe Your Goal in Natural Language

Now, instead of writing formulas, you simply tell the AI what you want to achieve. Open the chat interface and type your request. You can be descriptive and specific.

Here are a few examples of prompts you could use:

- "Using the 'Factors' sheet as a reference, calculate the annual insurance premium. The inputs are on the 'Calculator' sheet. The final premium is the 'Building Value' multiplied by the sum of all applicable rating factors found in the 'Building' and 'Finishing' tables."

- "For the property described in the 'Calculator' sheet, find the rate for each factor from the tables on the 'Factors' sheet. Then, sum these rates and multiply by the building value to get the final premium."

- "Create a summary that calculates the total insurance premium based on the inputs on one sheet and the lookup tables on another."

3. Review and Iterate on the Results

Excelmatic will process your request, perform all the necessary lookups behind the scenes, and present you with the final calculated premium.

But the real power lies in the conversational aspect. You can continue the dialogue to refine the analysis or explore scenarios—something that's extremely cumbersome with a formula-based calculator.

- Ask for a breakdown: "Can you show me a table with each factor and its corresponding rate?"

- Test a scenario: "What would the premium be if the roof age was 'New (<5 years)'?"

- Perform a comparison: "Compare the final premium for 'Frame' construction versus 'Masonry' construction."

4. Export Your Results

Once you're satisfied, you can download the results as a new Excel file, which might include the final calculated premium, a breakdown table, or even the formulas that the AI generated for you to use in your own workbook.

Example Dialogue with Excelmatic

Here’s how a typical conversation might look:

User: I've uploaded my insurance calculator file. Can you calculate the annual premium based on the inputs in the 'Calculator' sheet and the rate tables in the 'Factors' sheet?

Excelmatic: Certainly. Based on a building value of $500,000, 'Frame' construction, '26-50 years' old, and the other specified factors, I've looked up all the corresponding rates. The calculated annual premium is $2,450. Would you like a breakdown of the calculation?

User: Yes, and also tell me what the premium would be if the construction type was changed to 'Masonry', keeping all other factors the same.

Excelmatic: Here is the breakdown of the original calculation:

| Factor | Selection | Rate |

|---|---|---|

| Building Age/Type | Frame, 26-50 yrs | 0.0025 |

| Roof Age | 11-20 years | 0.0008 |

| Plumbing Age | 11-20 years | 0.0006 |

| ... | ... | ... |

| Total Rate | 0.0049 |

If the construction type is changed to 'Masonry', the new building rate would be 0.0018. The new total premium would be $2,100, a saving of $350 per year.

Traditional Method vs. Excelmatic: A Quick Comparison

| Aspect | Traditional Excel Method | Excelmatic AI Method |

|---|---|---|

| Time to Build | Hours, depending on complexity | Minutes |

| Required Skill | Advanced (INDEX/MATCH, named ranges) | Basic (Describing your business need) |

| Error Rate | High (typos, incorrect ranges) | Near-zero (AI handles logic) |

| Flexibility | Low (rigid structure) | High (conversational, easy to change scenarios) |

| Maintenance | Difficult (revising complex formulas) | Effortless (just upload the new rate file) |

FAQ

Q: Do my lookup tables need to be in a special format for Excelmatic to understand them? A: No. As long as your tables are clearly structured with headers for rows and columns, Excelmatic's AI is designed to understand their layout automatically. Standard, clean data practices are all you need.

Q: Is my company's financial and rate data secure when I upload it to Excelmatic? A: Data security is a top priority. Excelmatic is built with enterprise-grade security protocols to ensure your data is kept private and safe. For specific details, you can always refer to the official privacy policy on the website.

Q: Can Excelmatic handle more complex calculations than just lookups and sums? A: Absolutely. Excelmatic can perform a wide range of operations, from statistical analysis and forecasting to complex financial modeling. You can simply describe the calculation you need in your prompt.

Q: Can Excelmatic create the dropdown menus (Data Validation) in the Excel file for me? A: Excelmatic's primary focus is on data analysis, transformation, and generation of results like tables, charts, and formulas. While it doesn't directly modify your original file to add data validation, you can easily use the AI-generated results in an Excel template you've already prepared with dropdowns.

Q: What if I'm a complete Excel beginner? Is Excelmatic for me? A: Yes. In fact, Excelmatic is an ideal tool for beginners. It bridges the gap between knowing what you want to do and knowing how to do it in Excel. If you can describe your goal, you can use Excelmatic to get the result without needing to learn any formulas.

Get Started Instantly: Upgrade Your Excel Workflow

Continuing to build and maintain manual, formula-heavy calculators in Excel is a significant drain on time and a constant source of risk. Every hour spent debugging an INDEX/MATCH formula is an hour not spent analyzing results or serving your clients.

By embracing an Excel AI agent, you can transform this entire workflow. You can build more accurate, flexible, and robust tools in a fraction of the time. You can answer complex "what-if" questions on the fly and empower your entire team to leverage data without needing to be Excel gurus.

Ready to see for yourself? Try Excelmatic for free today. Upload the spreadsheet you're currently wrestling with and ask it the question you're trying to answer. You might just get your answer before you finish your next cup of coffee.