Key takeaways:

- Calculating compound interest in Excel traditionally requires manually building formulas or mastering the complex

FVfunction, which is time-consuming and prone to errors, especially when comparing different scenarios. - Excel AI tools like Excelmatic eliminate this complexity. You can simply ask in plain language to calculate future value, compare compounding periods, or project growth over time, without writing a single formula.

- Using Excelmatic for financial projections saves significant time, increases accuracy, and provides the flexibility to instantly explore "what-if" scenarios, transforming a tedious task into a quick conversation.

The Challenge: Projecting Your Financial Future in Excel

Whether you're an individual planning for retirement, a parent saving for a child's education, or a financial analyst modeling investment returns, calculating compound interest is a fundamental task. It's the engine of wealth growth, where your money starts making money for you.

Excel is the go-to tool for this, but let's be honest: it's not always straightforward. You have your key numbers: a principal amount, an annual interest rate, and an investment term. The goal is to see what this investment will be worth in the future.

The problem arises when you need to compare options. What if the interest is compounded monthly instead of annually? What would the growth look like year by year over a decade? What if you increase your initial investment? Each question sends you back to the formula bar, tweaking cell references, dividing rates, and multiplying time periods. It's a manual, error-prone process that stifles quick decision-making.

The Traditional Excel Method: Formulas and Functions

To calculate the future value of an investment, Excel users typically rely on two methods: the direct mathematical formula or Excel's built-in FV (Future Value) function.

Method 1: The Manual Compound Interest Formula

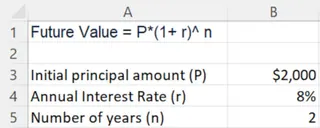

The classic formula for compound interest is:

Future Value = P * (1 + r)^n

Where:

- P is the initial principal amount.

- r is the annual interest rate.

- n is the number of years.

To implement this in Excel, you'd set up a sheet with your variables and write the formula using cell references.

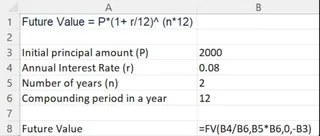

For an initial investment of $2,000 at an 8% annual rate for 2 years, your setup would look like this:

The formula would be =B3*(1+B4)^B5, which correctly yields $2,332.80.

The Limitations:

This seems simple enough for one calculation, but the complexity quickly grows.

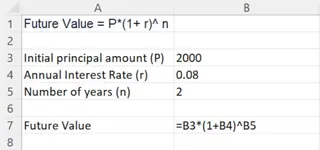

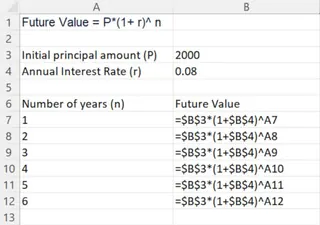

- Changing Compounding Periods: What if interest is compounded monthly? You must manually adjust the formula: the rate

rbecomesr/12and the periodsnbecomen*12. The new formula isP * (1 + r/12)^(n*12). Forgetting to adjust both parts is a common mistake. - Projecting Over Multiple Years: To see year-by-year growth, you have to create a table and carefully drag the formula down. This requires using absolute references (

$B$3,$B$4) for the principal and rate, and a relative reference for the year. A misplaced$sign can break the entire projection.

- It's Not Intuitive: The formula itself isn't self-explanatory. A colleague or your future self might struggle to understand the logic without careful review.

Method 2: The FV (Future Value) Function

Excel provides the FV function to simplify this. The syntax is:

=FV(rate, nper, pmt, [pv], [type])

- rate: The interest rate per period.

- nper: The total number of payment periods.

- pmt: The payment made each period (for annuities).

- pv: The present value, or initial principal.

- type: When payments are due (optional).

Using the FV function for our monthly compounding example ($2,000 at 8% for 2 years), the formula would be =FV(B4/12, B5*12, 0, -B3).

The Limitations:

While FV is powerful, it has its own learning curve.

- Argument Confusion: You have to remember what each argument means. Why does

rateneed to be divided by 12? Why doesnperneed to be multiplied? - The Negative

pv: A common point of confusion is that thepv(present value) must be entered as a negative number to get a positive future value, representing a cash outflow. Forgetting this results in a negative and often perplexing result. - Inflexibility: Like the manual formula, comparing scenarios (e.g., monthly vs. quarterly compounding) still requires setting up different

FVformulas for each case. It doesn't facilitate quick, conversational analysis.

The New Way: Calculate Compound Interest with Excel AI (Excelmatic)

Instead of memorizing formulas and wrestling with syntax, what if you could just ask Excel for the answer? That's the power of an Excel AI Agent like Excelmatic. It replaces manual formula-building with simple, natural language conversation.

The process is refreshingly simple. You upload your data (or just state the parameters in the chat) and tell the AI what you need.

Step-by-Step Guide with Excelmatic

Let's solve the same financial problems without touching the formula bar.

1. Start the Conversation

You don't even need to upload a file for a straightforward calculation. You can simply provide the parameters directly in the chat.

2. Ask for What You Need in Plain Language

Instead of translating your question into a formula, just ask it directly.

Here are some example prompts you could use:

To calculate the basic future value:

What is the future value of a $2,000 investment after 2 years with an 8% annual interest rate, compounded annually?

To create a year-by-year projection:

Show me the year-by-year growth of a $2,000 investment over 10 years at an 8% annual interest rate. The interest is compounded annually. Show the year, starting balance, interest earned, and ending balance.

To compare different compounding periods:

Compare the final value of a $5,000 investment over 10 years at a 6% annual rate, assuming it is compounded annually, quarterly, and monthly. Show the results in a table.

3. Get Instant Results & Iterate

Excelmatic will analyze your request and generate the result—whether it's a single value, a detailed table, or even a formula if you ask for it.

The real magic is in the follow-up. You can continue the conversation to refine or expand your analysis.

Dialogue Example: A Financial Planning Conversation

Here's how a typical interaction with Excelmatic might look:

User: I have a starting principal of $2,000. The annual interest rate is 8%. I want to invest for 5 years. Can you calculate the future value if the interest is compounded monthly?

Excelmatic: Certainly. The future value of your $2,000 investment over 5 years at an 8% annual rate, compounded monthly, will be $2,979.69.

I have generated a table showing the calculation. Would you like to see the year-by-year breakdown?

User: Yes, show me the breakdown. And what would the value be if it were compounded annually instead?

Excelmatic: Here is the year-by-year breakdown for the monthly compounding scenario.

For the same investment compounded annually, the future value after 5 years would be $2,938.66.

The monthly compounding results in an additional $41.03 over the 5-year period.

User: Great. Now, please generate a line chart comparing the growth of the monthly vs. annual compounding over the 5-year period.

Excelmatic: Done. I have created a line chart comparing the two compounding scenarios. You can see that the 'Compounded Monthly' line trends slightly higher than the 'Compounded Annually' line over time. You can download the Excel file containing this chart and the data.

Traditional Method vs. Excelmatic: A Quick Comparison

| Aspect | Traditional Excel (Manual/FV Function) | Excelmatic (AI Agent) |

|---|---|---|

| Speed | Slow. Requires setup, formula entry, and debugging. | Fast. Get answers in seconds. |

| Learning Curve | Moderate to High. Need to learn formula syntax, function arguments, and cell referencing. | Very Low. If you can describe your goal, you can use it. |

| Flexibility | Low. "What-if" analysis requires manually changing inputs or formulas. | High. Effortlessly explore scenarios with follow-up questions. |

| Error Rate | High. Prone to typos, incorrect references ($), and logical errors. |

Low. The AI handles the complex syntax and calculations, reducing human error. |

| Clarity | Low. Formulas can be cryptic and hard to audit. | High. The conversation history serves as a clear, readable record of the analysis. |

FAQ

Q1: Do I need to know any Excel formulas to use Excelmatic for financial calculations? No, not at all. You just need to describe the outcome you want in plain language. Excelmatic translates your request into the necessary calculations, whether it's a simple sum or a complex financial model.

Q2: Is my financial data secure when I upload it to Excelmatic? Excelmatic is built with data security as a top priority. Files are processed in a secure environment and are not used for training models. For specific details, always refer to the official privacy policy on the website.

Q3: Can Excelmatic handle more complex financial scenarios, like loans or investments with regular contributions? Yes. You can ask more advanced questions, such as "Calculate the future value of an investment with a $10,000 initial principal and additional monthly contributions of $200 for 15 years at a 7% annual rate." The AI is designed to understand and process these multi-part financial queries.

Q4: Can I get the Excel formula from Excelmatic?

Absolutely. You can ask the AI to "give me the Excel formula to do this," and it will generate the correct formula (e.g., using the FV function) that you can copy and paste directly into your own spreadsheet. This is a great way to learn while getting your work done.

Q5: What if my data isn't perfectly clean? Excelmatic is designed to be robust. It can often interpret datasets with inconsistent naming or formatting. For best results, it's always good practice to have clear column headers (e.g., "Principal," "Interest Rate," "Term in Years").

Take Action: Upgrade Your Excel Workflow Today

Stop spending valuable time decoding FV function arguments or debugging compound interest formulas. Your ability to make smart financial decisions shouldn't be limited by your mastery of complex Excel syntax.

With an Excel AI agent, you can shift your focus from how to calculate to what to analyze. Ask questions, compare scenarios, and get insights in a fraction of the time.

Ready to experience the future of spreadsheet analysis? Try Excelmatic today. Upload a sample investment sheet or simply start a new conversation with the prompts from this article, and watch your financial questions get answered in seconds.