Key takeaways:

- Traditional Excel tax preparation involves hours of manual work: downloading statements, categorizing each transaction by hand, and building complex

SUMIFformulas to summarize totals. - Excel AI agents like Excelmatic eliminate this drudgery. Simply upload your transaction data and use plain language to have the AI automatically categorize expenses and generate summary reports.

- Using Excelmatic drastically reduces preparation time from days to minutes, improves accuracy by removing manual data entry errors, and provides the flexibility to ask ad-hoc financial questions without writing a single formula.

The Annual Agony of Tax Prep in Excel

For freelancers, consultants, and small business owners, "tax time" often brings a familiar sense of dread. It's not just about paying the taxes; it's the monumental task of organizing a year's worth of financial data. The process usually begins with downloading endless bank and credit card statements, often in CSV or Excel format.

You're then faced with a wall of data: hundreds, or even thousands, of individual transactions. Your mission, should you choose to accept it, is to transform this raw data into a neat summary that your accountant (or tax software) can understand. This means manually adding a "Category" column and painstakingly assigning a label to every single line item: "Software," "Client Meals," "Office Supplies," "Travel," and so on.

A single year of activity can easily mean a full weekend lost to this tedious task. A typo like "Offiec Supplies" can break your summary formulas, leading to a frantic search for the error. You feel more like a data entry clerk than a business owner, and every minute spent on this is a minute not spent growing your business.

The Traditional Excel Solution: Steps and Limitations

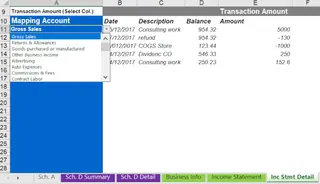

To bring order to this chaos, many turn to the classic "Tax Tracker" spreadsheet. This is a structured workbook designed to categorize transactions and summarize them for tax forms like Schedule C. While better than no system at all, it's a masterclass in manual, error-prone work.

The typical workflow looks something like this:

Data Dump: You start by copying and pasting all your transaction data from various bank and credit card files into a single "Transactions" or "Detail" worksheet.

Manual Categorization: This is the most labor-intensive step. You go row by row, assigning a category to each expense or income item. To avoid typos, you might set up a Data Validation dropdown list. While this ensures consistency, you're still manually selecting a category for every single transaction.

Summarization with

SUMIF: On a separate "Summary" sheet, you list all your tax categories. Next to each category, you write aSUMIFformula to calculate the total. The formula looks something like this:=SUMIF(Transactions!A:A, "Office Supplies", Transactions!D:D)This formula tells Excel to look in the "Category" column (A:A) of your

Transactionssheet, find all rows matching "Office Supplies," and add up the corresponding values from the "Amount" column (D:D). You have to create a separateSUMIFformula for every single category.

Data Cleaning: Sometimes, your bank data isn't perfect. You might find numbers formatted as text, which breaks your

SUMIFformulas. To fix this, you have to create a helper column and use theVALUE()function to convert the text back into numbers that Excel can calculate.

The Limitations of the Manual Method

While this system can eventually get you the numbers you need, it's fraught with problems:

- Incredibly Time-Consuming: The sheer volume of manual categorization is a huge time sink. What if you have 2,000 transactions? That's 2,000 manual decisions and clicks.

- Rigid and Inflexible: Your

SUMIFsummary is static. What if your accountant asks, "What were your total travel expenses for the second quarter?" or "Can you show me your top 5 expense categories for December?" Answering these questions requires building new, filteredSUMIFformulas or a complex Pivot Table. - High Risk of Errors: A single mistake—a miscategorized transaction, an incorrect formula range, a typo in a category name—can lead to inaccurate totals, potentially costing you hundreds or thousands of dollars in overpaid taxes or audit penalties.

- Difficult to Maintain: The process isn't a one-and-done affair. You have to repeat it every month or quarter to stay on top of your finances, and it's a nightmare to troubleshoot if something goes wrong.

- Steep Learning Curve: To do this properly, you need to be comfortable with

SUMIF,Data Validation, and potentially other functions likeSUBTOTALandVALUE. It's not a friendly process for Excel beginners.

The New Approach: Using an Excel AI Agent (Excelmatic)

Instead of forcing you to become a formula expert and a data entry machine, modern tools like Excelmatic act as your personal data analyst. Excelmatic is an Excel AI Agent that lets you use plain language to get insights from your data, completely bypassing the manual steps.

The paradigm shifts from telling Excel how to do something (with formulas) to telling the AI what you want to achieve.

Step-by-Step: Automating Your Tax Prep with Excelmatic

Let's revisit the same tax preparation scenario, but this time with Excelmatic.

- Upload Your Transaction Data

Simply drag and drop your transaction CSV or Excel file directly into the Excelmatic chat interface. The AI will instantly read your data and show you a preview. Ensure your columns have clear headers like

Date,Description, andAmount.

Ask the AI to Categorize and Summarize This is where the magic happens. Instead of manually categorizing, you just tell the AI what to do in plain language.

You can start with a broad request:

Based on the 'Description' column, create a new column named 'Category'. Assign categories like 'Software', 'Office Supplies', 'Travel', 'Client Meals', 'Contractors', and 'Utilities'. Identify all deposits as 'Client Revenue'.

The AI will analyze the descriptions and intelligently categorize all your transactions in seconds.

Then, ask for the summary:

Now, create a summary table showing the total amount for each category. Sort it from highest to lowest expense.

Refine and Analyze with Follow-up Questions This is where an AI agent truly shines. Your data is now a dynamic, conversational dashboard. You can ask follow-up questions to dig deeper.

- "What were my total expenses for Q3 2024?"

- "Create a pie chart showing the percentage of each expense category."

- "Show me a list of all transactions categorized as 'Travel'."

- "Calculate my net income for the year by subtracting total expenses from total revenue."

Export Your Clean Results Once you have the exact reports you need, you can download the results. Excelmatic allows you to export the fully categorized transaction list, the summary pivot table, and any charts you created into a brand new, perfectly formatted Excel file. You can hand this clean file to your accountant, saving them time and saving you money on their fees.

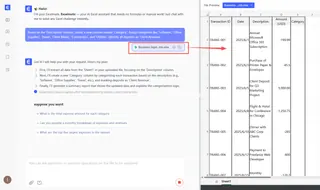

A Sample Conversation

Here’s how a typical interaction might look in Excelmatic:

User: Here's my full-year bank statement from 2023. Please help me prepare it for my tax accountant.

Excelmatic: Of course. I've analyzed your data, which contains 1,842 transactions. What would you like to do first?

User: Please create a new 'Category' column. Use the transaction description to categorize everything. My main expense categories are 'Software Subscriptions', 'Contractor Payments', 'Office Supplies', 'Travel & Lodging', and 'Client Meals'. All incoming funds are 'Client Revenue'.

Excelmatic: I have added the 'Category' column and categorized all 1,842 transactions based on your instructions. I've also created a pivot table summarizing the total for each category. Your total 'Client Revenue' is $125,450 and your total expenses are $48,970.

User: Great. Now create a bar chart showing my top 5 expense categories. And can you filter the main transaction list to show me only the 'Contractor Payments' over $1,000?

Excelmatic: Done. The bar chart is ready, showing 'Contractor Payments' as your highest expense. I've also applied the filter to your transaction data. You can now download the updated Excel file containing the categorized list, the summary pivot table, and the chart.

Traditional Method vs. Excelmatic: A Quick Comparison

| Aspect | Traditional Excel Method | Excelmatic (AI Agent) |

|---|---|---|

| Time | Hours, or even days | Minutes |

| Process | Manual categorization, formula writing | Natural language conversation |

| Accuracy | High risk of human error | Consistent and automated |

| Flexibility | Rigid; new questions require new formulas | Dynamic; ask any question on the fly |

| Skill Level | Intermediate Excel skills required | No formula knowledge needed |

FAQ

Do I need to know formulas like SUMIF to use Excelmatic?

No. You don't need to write any formulas at all. You simply describe the outcome you want in plain language, and the AI generates the result, whether it's a categorized list, a summary table, or a chart.

Is it safe to upload my financial data to Excelmatic? Yes. Excelmatic prioritizes data security. Your data is encrypted in transit and at rest, and it is never used to train AI models. It's a secure environment designed for business professionals. For more details, always refer to the official privacy policy.

Will Excelmatic modify my original Excel file? No. Your original file remains untouched on your computer. Excelmatic works on a copy of your data in its secure cloud environment. You can then download the results as a new Excel file.

What if my transaction descriptions are messy or inconsistent? AI is surprisingly good at handling messy data. It can often understand that "Amazon Web Services," "AWS Bill," and "AMZN WEBSERVICES" all belong to the same "Cloud Services" or "Software" category. You can also provide guidance in the chat to correct or refine its categorization.

Can Excelmatic replace my accountant? No. Excelmatic is not a replacement for a certified public accountant (CPA). It is a powerful tool to assist you and your accountant. By providing them with perfectly clean, categorized, and summarized data, you make their job easier, faster, and less expensive.

Can I export the results back to Excel?

Absolutely. You can download your categorized data, pivot tables, and charts as a new .xlsx file, ready for further use or for sending to your accountant.

Get Started: Streamline Your Tax Workflow with Excelmatic

The annual ritual of wrestling with spreadsheets for tax season doesn't have to be a source of stress. The hours spent manually categorizing transactions and debugging SUMIF formulas are better invested in your business.

By embracing an Excel AI agent, you can transform this tedious chore into a quick, simple, and even insightful process. You not only get your tax data ready in record time but also gain the ability to ask critical questions about your business finances throughout the year.

Ready to reclaim your weekends? Try Excelmatic for free today. Upload a transaction file and use the prompts from this article to see how quickly you can get your finances in order.