Key takeaways:

- E-commerce financial dashboards turn fragmented financial data into decision-ready insight, helping teams understand profitability, cash flow, and growth health.

- Effective dashboards focus on core financial questions, such as sustainable profit, cash alignment, and channel-level performance.

- Different dashboard types serve distinct needs, including profitability analysis, cash flow monitoring, cost control, forecasting, and multi-platform oversight.

- Despite varying use cases, most e-commerce financial dashboards rely on shared metrics covering revenue, costs, profitability, cash flow, and efficiency.

- AI-powered tools like Excelmatic simplify dashboard creation by transforming existing financial data into flexible, evolving dashboards without manual rebuilding.

In e-commerce, revenue is visible—but financial clarity often isn’t.

Orders are coming in, ad spend keeps rising, and dashboards are filled with numbers. Yet many e-commerce teams still struggle to answer basic questions: Are we actually profitable? Where is cash getting stuck? Which channels are driving healthy growth instead of hidden risk?

This gap between data availability and financial understanding is exactly where an AI-powered e-commerce financial dashboard becomes essential.

Rather than replacing spreadsheets, AI dashboards reshape how financial data is interpreted — turning fragmented reports into decision-ready insight.

What an Effective E-commerce Financial Dashboard Should Reveal

The goal of a financial dashboard is not to show everything — it is to support better decisions.

In practice, high-performing e-commerce dashboards help teams answer three critical questions:

Are we generating sustainable profit?

This requires more than revenue tracking. Profitability emerges only when advertising costs, platform fees, fulfillment expenses, and refunds are analyzed together.Is cash flow aligned with growth?

Fast growth often hides cash pressure. Dashboards should make it easy to see when sales outpace cash availability or when working capital is tightening.Which channels and products create healthy returns? AI dashboards help surface patterns across products, campaigns, and regions — highlighting where financial performance is resilient versus fragile.

When metrics clearly support these decisions, dashboards become operational tools rather than passive reports.

Common Types of E-commerce Financial Dashboards

E-commerce financial dashboards are built around specific financial questions. While they share core data foundations, each type serves a distinct decision-making purpose.

1. Profitability Dashboard

This dashboard focuses on understanding how much the business actually earns after all costs. It combines revenue with advertising spend, platform fees, fulfillment costs, and returns to reveal true profit margins by product, channel, or campaign. It is often used to evaluate which products or channels are worth scaling.

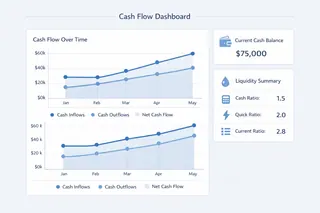

2. Cash Flow Dashboard

Cash flow dashboards track how money moves in and out of the business over time. They highlight inflows, outflows, payment timing, and cash balance trends. For e-commerce teams managing inventory purchases, ad spend, and platform payouts, this dashboard helps prevent liquidity issues even when sales appear strong.

3. Marketing Spend & Cost Control Dashboard

This type of dashboard is designed to monitor financial efficiency. It connects marketing spend, customer acquisition costs, operating expenses, and revenue outcomes. Teams use it to detect rising costs early and understand whether increased spending is translating into sustainable growth.

4. Forecasting and Budget Tracking Dashboard

Forecast-focused dashboards compare actual financial performance against projections or budgets. They help finance and operations teams assess whether revenue targets, cost assumptions, and cash plans remain realistic as conditions change.

5. Multi-Platform Financial Overview Dashboard

For businesses selling across multiple marketplaces or regions, this dashboard consolidates financial data from different platforms into a unified view. It enables consistent performance comparison and reduces the complexity of managing fragmented financial reports.

Key Metrics Shared Across Most E-commerce Financial Dashboards

While each dashboard type serves a different purpose, effective e-commerce financial dashboards rely on a shared set of core metrics. These metrics provide a consistent foundation for analysis and decision-making.

| Metric Category | Key Metrics | What They Indicate |

|---|---|---|

| Revenue Performance | Total Revenue, Net Revenue, Average Order Value | Overall sales strength and pricing effectiveness |

| Cost Structure | Advertising Spend, Fulfillment Costs, Platform Fees | How much growth and operations actually cost |

| Profitability | Gross Margin, Contribution Margin, Net Profit | Whether revenue translates into sustainable profit |

| Cash Flow | Cash Inflows, Cash Outflows, Cash Balance | Liquidity health and timing-related financial risk |

| Efficiency & Control | Customer Acquisition Cost, Cost-to-Revenue Ratio | Financial efficiency across channels and campaigns |

The purpose of these metrics is not volume, but clarity. Each metric should directly support a financial decision — whether to scale, optimize, or correct course. Metrics that do not inform action add noise rather than insight.

Choosing the Right Tool to Build an E-commerce Financial Dashboard

Understanding what a dashboard should include is only half the challenge. The other half is execution.

Many teams attempt to build e-commerce financial dashboards manually in spreadsheets. While familiar, this approach becomes fragile as data sources grow and questions change. Each new analysis requires restructuring files, rewriting formulas, and rebuilding charts.

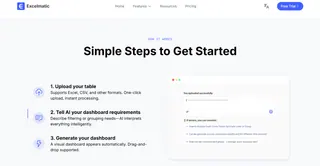

This is where AI-powered dashboard tools like Excelmatic change the workflow.

Simply upload your spreadsheet, describe your analysis needs in natural language, and Excelmatic intelligently interprets the context to generate an interactive dashboard

Instead of designing dashboards from scratch, teams can upload existing financial data and explore it through natural questions. Excelmatic reads the data structure, connects related metrics, and generates dashboards automatically — allowing users to focus on insight rather than setup.

From Financial Data to Confident Decisions

An e-commerce financial dashboard is not just a reporting tool — it is a decision system.

When financial insight becomes easier to access and faster to interpret, teams respond earlier, plan more confidently, and manage growth with greater control. AI makes this possible by reducing friction between data and understanding.

If you are ready to move beyond static reports and build a financial dashboard that adapts to your e-commerce business, start building with Excelmatic today.

Frequently Asked Questions (FAQ)

Q: What is an e-commerce financial dashboard used for?

A: It helps e-commerce teams monitor profitability, cash flow, and financial efficiency in one unified view to support better financial decisions.

Q: How is an e-commerce financial dashboard different from standard financial reports?

A: Dashboards are interactive and decision-oriented, while reports are static summaries of past performance.

Q: Which metrics matter most in an e-commerce financial dashboard?

A: Core metrics typically include revenue, costs, profit margins, cash flow, and customer acquisition efficiency.

Q: Do small e-commerce teams need financial dashboards?

A: Yes. Dashboards help small teams detect cash pressure, rising costs, and unprofitable growth earlier, even with limited resources.

Q: Can AI tools build e-commerce financial dashboards automatically?

A: AI-powered tools like Excelmatic can read existing financial data and generate dashboards dynamically without manual setup.