Key takeaways:

- Manually building a loan amortization schedule in Excel requires complex formulas like PMT and careful, error-prone data entry for each payment period over hundreds of rows.

- Excel AI tools like Excelmatic automate this entire process. You can simply describe your loan terms in plain English to generate a complete and accurate schedule instantly.

- Using Excelmatic not only saves significant time but also allows for effortless scenario analysis—just ask "what if the interest rate was 9%?" to see updated results without rebuilding any formulas.

Problem Background & Pain Points

Whether you're planning to buy a house, finance a new car, or take out a business loan, understanding the true cost of borrowing is crucial. A loan amortization schedule is the perfect tool for this. It provides a detailed, period-by-period breakdown of each payment, showing exactly how much goes toward interest and how much reduces your principal debt.

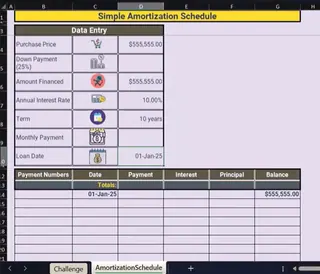

Imagine you're looking at a property priced at $555,555. You've saved up for a 25% down payment and plan to finance the rest. A bank has offered you a 10-year loan with a 10% annual interest rate. Before you sign on the dotted line, you need answers to critical questions:

- What will my exact monthly payment be?

- How much interest will I pay in the first year versus the last year?

- What is the total interest I'll pay over the entire 10-year term?

- How does the outstanding balance decrease over time?

For many Excel users, the immediate reaction is to build a spreadsheet. But this is where the headache begins. You need to recall specific financial functions, structure a table correctly, and painstakingly drag formulas down for every single payment period—in this case, 120 months. A single mistake in an early formula can throw off the entire calculation, leading to incorrect financial planning.

The Traditional Excel Solution: Steps and Limitations

The classic approach to building an amortization schedule in Excel is a powerful demonstration of its calculation capabilities, but it's also a masterclass in manual, repetitive work. It involves a combination of financial functions and careful table construction.

Here's a summary of the manual process:

Step 1: Calculate Key Loan Parameters

First, you need to calculate the actual loan amount. With a $555,555 price and a 25% down payment, the amount to be financed is:

$555,555 * (1 - 0.25) = $416,666.25

Step 2: Calculate the Monthly Payment with the PMT Function

Next, you use Excel's PMT function to determine the fixed monthly payment. The formula looks like this:

=PMT(rate, nper, pv)

- rate: The interest rate per period. Since the 10% rate is annual, you must divide it by 12.

- nper: The total number of payment periods. For a 10-year loan, this is 10 * 12 = 120.

- pv: The present value, or the total loan amount ($416,666.25).

The complete formula would be =PMT(10%/12, 120, 416666.25), which yields a monthly payment of $5,506.23.

Step 3: Build the Amortization Table

This is the most labor-intensive part. You create a table with columns like: Period, Payment Date, Monthly Payment, Interest Paid, Principal Paid, and Remaining Balance.

- For the first row (Period 1):

- Interest Paid:

Beginning Balance * (10% / 12) - Principal Paid:

Monthly Payment - Interest Paid - Remaining Balance:

Beginning Balance - Principal Paid

- Interest Paid:

- For all subsequent rows:

- The

Beginning Balanceis theRemaining Balancefrom the previous row. - You then repeat the interest and principal calculations and drag the formulas down for all 120 rows.

- The

Limitations of the Manual Method

While this method works, it's fraught with challenges that make it impractical for quick analysis or for users who aren't Excel formula experts:

- Formula Complexity: You need to remember the

PMTfunction and its arguments. For more detailed analysis, you might also needIPMT(interest payment) andPPMT(principal payment), each with its own syntax. - Error-Prone Setup: The entire schedule's accuracy depends on correctly setting up the formulas in the first two rows, especially the cell references (using

$for absolute references is critical). A small error can cascade through all 120 periods, making the final numbers completely wrong. - Time-Consuming and Repetitive: Manually creating the date column, setting up the formulas, and dragging them down for 10, 15, or 30 years (360 rows!) is tedious and time-consuming.

- Inflexible for "What-If" Analysis: What if you find a better loan offer at 9.5%? Or what if you want to see the impact of making an extra $200 payment each month? Answering these questions requires you to go back, adjust your core parameters, and potentially rebuild or re-validate the entire table. It’s not a dynamic or conversational process.

The New Solution: Using Excel AI (with Excelmatic)

Instead of wrestling with formulas and manual table creation, you can now use an Excel AI Agent like Excelmatic to do all the heavy lifting. You simply describe your goal in plain language, and the AI generates the complete, accurate amortization schedule for you in seconds.

The Excelmatic Approach

The process is refreshingly simple and intuitive:

- Upload Your Data (or Don't!)

You can start with a blank sheet or upload a simple Excel file containing your loan parameters:

Property Price,Down Payment %,Interest Rate,Loan Term. Excelmatic will read and understand your column headers.

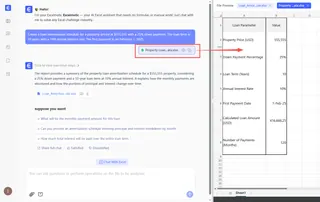

Describe Your Request in Natural Language This is where the magic happens. Instead of writing formulas, you write a sentence. Open the chat panel in Excelmatic and type your request.

For our scenario, you could ask:

Create a loan amortization schedule for a property priced at $555,555 with a 25% down payment. The loan term is 10 years with a 10% annual interest rate. The first payment is on February 1, 2025.

Or, if you prefer to break it down:

First, calculate the monthly payment for a $416,666.25 loan over 120 months at a 10% annual rate.

Then follow up with:

Now, generate the full amortization table showing the breakdown of principal and interest for each payment, along with the remaining balance.

Review and Iterate with Follow-up Questions Excelmatic will instantly generate the full 120-month table. But you don't have to stop there. The real power lies in the conversational analysis. You can continue asking questions to explore different scenarios:

- "What is the total interest paid over the life of the loan?"

- "Now, show me the same schedule but with a 9.5% interest rate."

- "Add a column showing the cumulative principal paid after each payment."

- "Generate a chart that compares the principal and interest portion of my payments over time."

Export Your Results Once you're satisfied, you can download the generated table, charts, and analysis as a new, perfectly formatted Excel file. You can also copy the formulas or PivotTable configurations that Excelmatic used if you want to integrate them into an existing workbook.

Example Dialogue with Excelmatic

Here's how a typical conversation might look:

User: I'm buying a property for $555,555 with a 25% down payment. The loan is for 10 years at a 10% annual interest rate. Can you build a full amortization schedule for me?

Excelmatic: Certainly. The loan amount is $416,666.25. The calculated monthly payment is $5,506.23. I have generated a complete 120-month amortization schedule with columns for Payment Date, Monthly Payment, Principal, Interest, and Remaining Balance. Would you like me to visualize the interest vs. principal payments over time with a chart?

User: Yes, please add a chart. Also, what if I make an extra payment of $500 each month? How much sooner would I pay off the loan and how much interest would I save?

Excelmatic: I've added a stacked area chart to visualize the payment breakdown. With an extra $500 monthly payment, you would pay off the loan in 101 months instead of 120, saving you 19 months and approximately $49,150 in total interest. I have updated the schedule to reflect this new scenario.

Traditional Method vs. Excelmatic: A Quick Comparison

| Aspect | Traditional Excel Method | Excelmatic AI Method |

|---|---|---|

| Time to Create | 15-30 minutes (or more) | Less than 1 minute |

| Required Skill | Intermediate/Advanced Excel (PMT, absolute references) | Basic language commands |

| Accuracy | Prone to manual formula errors | High, calculations are automated |

| Flexibility | Rigid; changes require manual formula edits | Highly flexible; analyze scenarios via chat |

| "What-If" Analysis | Cumbersome and slow | Instant and conversational |

FAQ

1. Do I need to know financial functions like PMT to use Excelmatic? No. You don't need to know any specific Excel functions. You just need to describe the loan scenario in plain language, and Excelmatic will apply the correct formulas automatically.

2. Is my financial data safe when I upload it to Excelmatic? Excelmatic is built with data security in mind. All data is encrypted in transit and at rest. For specific details on privacy and security policies, it's always best to consult the official website.

3. Can Excelmatic handle more complex scenarios, like extra payments or variable rates? Yes. You can easily model these scenarios through follow-up questions. For instance, you can ask, "Show me the impact of a one-time lump sum payment of $10,000 in month 24" or "What if the rate changes to 11% after the first 5 years?".

4. Can I export the amortization schedule back into Excel?

Absolutely. You can download the complete, formatted table and any generated charts as a standard .xlsx file with a single click.

5. What if my request is unclear? Will the AI get it wrong? If a request is ambiguous, Excelmatic will often ask for clarification to ensure it delivers the correct result. The conversational interface allows you to easily correct or refine your request until the output is exactly what you need.

6. Is this only for mortgages, or can I use it for car loans and personal loans too? This method works for any standard amortizing loan, including mortgages, auto loans, personal loans, or business loans. Just provide the principal, interest rate, and term.

Take Action: Upgrade Your Excel Workflow Today

Stop spending valuable time building and debugging financial schedules from scratch. The manual process is not only slow but also locks your analysis into a rigid structure. Every "what-if" question becomes a new project.

With an Excel AI agent like Excelmatic, you transform financial analysis from a chore into a conversation. You can explore options, compare loan offers, and understand the impact of your financial decisions in a fraction of the time.

Ready to stop wrestling with formulas? Try Excelmatic today and generate your next loan amortization schedule in seconds. Simply upload your data or start fresh, and use the prompts from this article to get started.