Key Insights

- The biggest obstacle to saving isn't a lack of desire—it's having no clue where your money actually went when you look at your statement at the end of the month.

- AI assistants transform budgeting from tedious data entry into a conversation with your spending habits, letting you finally see your money flow.

- This guide shows how to use an AI tool to go from expense review to a realistic savings plan in three simple steps, just by asking questions.

Payday hits. For a glorious moment, you feel rich. You can finally treat yourself, maybe even put a decent amount into savings this month. But then, the end of the month rolls around, and you’re staring at a low balance, wondering, “Where did all my money go?” You scan your statement, and sure, every transaction is accounted for, but it just doesn't add up.

Does this sound familiar? "I don't feel like I bought anything expensive, so how is it that my money just slips through my fingers?"

You’ve probably tried budgeting apps or manually tracking expenses in a spreadsheet. But the process is a chore. And at the end of the month, staring at a long list of transactions just brings anxiety, not clarity. Your plan to save money fizzles out. Again.

It's time for a smarter, more intuitive way to finally understand your money.

The Pain of Traditional Budgeting

When we try to manage our money the old-fashioned way, we often fall into three unavoidable traps:

1. The Tedium of Tracking: Logging every coffee, every Uber ride, and every online subscription is a massive test of willpower. It's a mechanical task that's easy to forget, leading to incomplete data that's almost useless for real analysis.

2. Analysis Paralysis: Even if you manage to track everything, it’s hard to spot patterns in a long list of numbers. You end up in a frustrating loop of, “I know I’m overspending, but I have no idea where to start cutting back.”

3. The Plan vs. Reality Disconnect: That ambitious New Year's resolution to "save $500 a month" quickly crumbles because it's not based on a clear understanding of your actual spending. Your plan and your spending habits end up existing on two different planets.

The Evolution of Budgeting: Let AI Be Your Financial co-pilot

Excelmatic is here to help you make every dollar count. Think of it as an "AI Budgeting Assistant" embedded in Excel. It can read and understand the transaction files you export from your bank or credit card, then help you make sense of it all through simple conversation.

The fundamental change is this: you go from being a tedious "bookkeeper" to a savvy "financial analyst" of your own life. You no longer need to manually enter or calculate anything. Just ask your questions, and the AI will turn your raw data into insightful charts that empower you to make a change.

Excelmatic: Your 3-Step Personal Budget Makeover

Getting Started: Get last month's spending report (exported as an Excel/CSV file from your banking app or credit card website). Open Excelmatic and upload the file.

Step 1: The Reality Check – See Where Your Money Went

First, get a clear picture of last month's spending. Ask your first question:

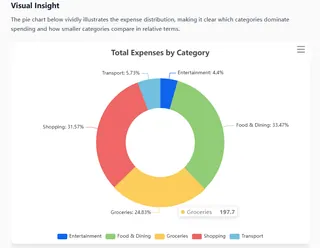

"This is my last month's statement. Can you categorize my spending and show me the breakdown in a pie chart?"

In seconds, the AI will automatically group your transactions (e.g., Dining Out, Groceries, Shopping, Transport, Entertainment) and generate a clean pie chart. You'll see your biggest spending areas at a glance.

Step 2: The Breakthrough – Find Where to Save

The pie chart shows "Food & Dining" is your biggest expense. Now you need to dig deeper to find opportunities to save. You continue the conversation:

"Okay, let's drill down into 'Food & Dining'. Show me how much I spent on food delivery, eating out, and groceries."

The AI will instantly generate a more detailed bar chart.

Step 3: The Plan – Create Your Savings Goal

With this insight, you can now create a realistic budget. Based on your analysis, you give your final command:

"Using last month's spending, create a budget for next month. Cap 'Dining Out' at $200 and 'Shopping' at $150, then show me how much I can save."

The AI will generate a clear monthly budget table, calculating your projected savings. This isn't a fantasy budget; it's an actionable plan based on your own real-world habits.

Frequently Asked Questions (FAQs)

Q: Can the AI understand the messy statement files I download from my bank? The formatting is never clean. A: Yes. Excelmatic's AI engine is trained to understand common statement formats from banks and credit card companies. It automatically identifies key information like merchant name, amount, and date, so you don't have to clean it up manually.

Q: What if the AI miscategorizes something? For example, it lists a vet visit under 'Shopping'. A: The AI does its best to intelligently categorize based on merchant names, but sometimes it needs a little guidance. No problem. In Excelmatic, you can easily correct it with a simple command, like: "Recategorize all transactions from 'City Pet Hospital' to 'Pet Expenses'." The AI learns your preferences for next time.

Q: I'm not an Excel whiz at all. Can I still use this? A: Absolutely. With Excelmatic, you don't need to know any formulas or how to build charts. The only skill you need is to ask for what you want in plain English, just like you're chatting with a person.

Conclusion

Breaking the paycheck-to-paycheck cycle isn't about extreme sacrifice. It's about clearly understanding your spending habits and making smart, informed adjustments.

An AI-powered tool like Excelmatic does this by automating and visualizing the tedious parts of budgeting. It gives you the power to easily gain insight into your own financial life, turning "saving money" from a vague goal into an achievable, data-driven plan.

It's time to start your smart savings journey and take back control of your finances.

Try Excelmatic now, and make your next budget the one that finally works.