As a User Growth Manager at Excelmatic, I’ve seen firsthand how financial tracking can make or break business decisions—and the same applies to personal finance. While tools like Excelmatic revolutionize AI-powered data analysis for businesses, many individuals and small teams still rely on free, accessible solutions like Google Sheets for budgeting.

The good news? Google Sheets offers a wealth of free templates to help you track expenses, manage savings, and even plan long-term financial goals—no advanced spreadsheet skills required. Below, I’ve curated the 10 best free budget templates, along with actionable tips to maximize their potential.

Why Use Google Sheets for Budgeting?

Before diving into the templates, let’s address why Google Sheets is a great starting point:

- Free and accessible: No subscriptions or installations needed.

- Collaborative: Share and edit budgets with family or team members in real time.

- Customizable: Adapt templates to fit your unique financial needs.

That said, if you’re ready to level up to AI-driven insights (like automated categorization, predictive budgeting, and interactive dashboards), tools like Excelmatic can seamlessly integrate with your spreadsheets for smarter financial planning.

1. Excelmatic’s Smart Budget Template (Customizable for Google Sheets)

Best for: AI-powered budgeting with seamless Google Sheets integration

While not a native Google Sheets template, Excelmatic offers a free, AI-enhanced budget template that syncs with Google Sheets for real-time updates. It automatically categorizes expenses, predicts future spending trends, and generates visual reports—saving you hours of manual work.

How to Use It:

- Download Excelmatic’s template and connect it to your Google Sheets.

- Input your income and expenses. The AI will auto-categorize transactions.

- Review dynamic dashboards to track savings goals and spending patterns.

Pro Tip: Use Excelmatic’s “What-If” scenarios to simulate financial decisions (e.g., "What if I save 10% more this month?").

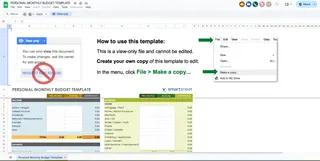

2. Personal Budget Template

Best for: Beginners who need a simple monthly overview

This classic template divides your finances into:

- Income sources

- Fixed expenses (rent, utilities)

- Variable expenses (groceries, entertainment)

- Savings goals

Step-by-Step:

- Enter monthly income.

- List fixed and variable expenses.

- The template auto-calculates your remaining balance.

Pro Tip: Color-code overspending categories to spot trends fast.

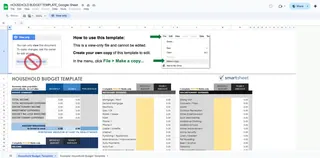

3. Family Budget Planner

Best for: Households managing shared expenses

Track multiple incomes, childcare costs, and family outings in one place. Includes:

- Shared savings goals

- Expense breakdowns by family member

Pro Tip: Hold a monthly “budget check-in” to align on goals.

4. Weekly Expense Tracker

Best for: Detail-oriented spenders*

Log daily transactions by category, with a weekly summary to curb overspending.

How to Use:

- Record expenses daily.

- Review totals every Sunday to adjust habits.

5. Annual Budget Planner

Best for: Long-term goal tracking*

Plan month-by-month for vacations, holidays, or debt repayment.

Pro Tip: Use Excelmatic to forecast annual trends based on historical data.

6-10. Other Notable Templates:

- Debt Payoff Tracker: Visualize progress on loans/credit cards.

- Event Budget Planner: Ideal for weddings or projects.

- Freelancer Budget: Track irregular income and taxes.

- Savings Goal Tracker: Motivate yourself with milestone visuals.

- Zero-Based Budget: Assign every dollar a purpose.

When to Upgrade to AI Tools Like Excelmatic

While Google Sheets templates are great for starters, scaling your financial analysis often requires smarter tools. Excelmatic enhances budgeting by:

✅ Automating data entry and categorization

✅ Generating predictive insights

✅ Creating interactive dashboards in seconds

Try Excelmatic’s free template to experience AI-powered budgeting today!

Final Thoughts

Whether you choose a simple Google Sheets template or an AI-driven solution like Excelmatic, the key to successful budgeting is consistency. Start with a template that matches your needs, and upgrade as your financial complexity grows.

Which template will you try first? Share your budgeting wins in the comments!