Budgeting is the backbone of financial health, whether you’re managing personal expenses, family finances, or business cash flow. While manual spreadsheets are a great starting point, modern professionals need tools that combine simplicity with advanced analytics.

In this guide, we’ll explore 10 free Google Sheets budget templates to help you track spending, reduce debt, and achieve savings goals. But for those ready to upgrade to AI-driven efficiency, Excelmatic offers seamless automation, real-time insights, and dynamic reporting—making it the ultimate solution for data-savvy users.

Why Use a Budget Template?

Before diving into the templates, let’s address why structured budgeting matters:

- Clarity: See exactly where your money goes.

- Control: Prevent overspending with real-time tracking.

- Goals: Track progress toward savings or debt reduction.

While Google Sheets templates provide a solid foundation, Excelmatic enhances this process with AI-powered automation, predictive analytics, and interactive dashboards—turning raw data into actionable insights.

Top 10 Free Google Sheets Budget Templates

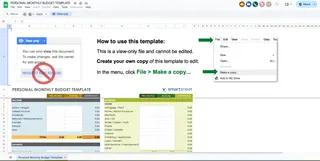

1. Personal Monthly Budget (Best for Individuals)

- Features:

- Track income vs. expenses in predefined categories (housing, groceries, etc.).

- Auto-calculates totals and generates pie charts.

- Excelmatic Upgrade: Replace manual entry with AI-driven expense categorization and predictive cash flow analysis.

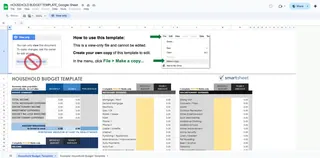

2. Family Budget Planner (Best for Households)

- Features:

- Manage multiple income sources and family-specific expenses (childcare, education).

- Monthly summaries for holistic financial views.

- Excelmatic Advantage: Sync shared expenses across family members with real-time collaboration.

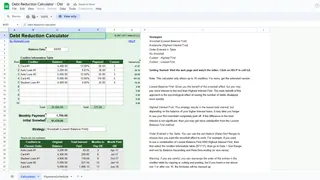

3. Debt Reduction Planner (Best for Paying Off Loans)

- Features:

- List debts, interest rates, and payment schedules.

- Visualize progress with amortization charts.

- Go Further: Excelmatic’s AI-powered debt optimization suggests the fastest payoff strategy.

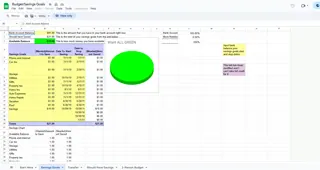

4. Savings Goal Tracker (Best for Targeted Saving)

- Features:

- Set goals (e.g., vacation, emergency fund) and track contributions.

- Progress bars for motivation.

- Smarter with AI: Excelmatic forecasts how small changes (e.g., cutting subscriptions) accelerate savings.

5. Weekly Expense Tracker (Best for Granular Spending Control)

- Features:

- Log daily/weekly spending to identify trends.

- Automate with Excelmatic: Link bank feeds for automatic transaction imports and anomaly alerts.

How to Supercharge Your Budgeting with Excelmatic

While Google Sheets templates are useful, AI tools like Excelmatic eliminate manual work and deliver deeper insights:

- Automate Data Entry: Connect bank accounts, credit cards, or accounting software to pull transactions automatically.

- Predictive Analytics: Forecast future cash flow based on spending patterns.

- Custom Dashboards: Visualize data with interactive charts—no formula skills needed.

👉 Try Excelmatic Free: Start Your AI-Powered Budget

Final Thoughts

Free Google Sheets templates are a great entry point, but for professionals who value time and accuracy, Excelmatic is the clear next step. By integrating AI, you transform budgeting from a chore into a strategic advantage.

Which will you choose? Stick with manual templates, or let AI do the heavy lifting?

P.S. Excelmatic offers a 14-day free trial—no credit card required. Experience AI-powered budgeting today.