Budgeting often feels like assembling a puzzle with missing pieces—especially for busy professionals juggling personal and business finances. While Excel templates provide structure, modern teams need more: automation, real-time insights, and scalability.

In this guide, we’ll explore 10 free Excel budget templates for personal and business use. But first, let’s address the elephant in the room: Manual data entry is outdated. Tools like Excelmatic (our AI-powered spreadsheet assistant) transform budgeting by automating calculations, generating forecasts, and even flagging anomalies—saving hours of manual work.

The Best Free Excel Budget Templates

1. Personal Monthly Budget Template

Best for: Individuals tracking income vs. expenses.

How it works:

- Input monthly income (salary, freelance work, etc.).

- Categorize expenses (housing, groceries, entertainment).

- Auto-calculates savings/deficits.

Pro Tip: For dynamic insights, upload this template to Excelmatic. Our AI analyzes spending patterns and suggests optimizations—like identifying subscription leaks.

2. Family Budget Planner

Best for: Households managing shared finances.

Features:

- Tracks multiple income streams (e.g., dual salaries).

- Pre-filled categories for childcare, education, etc.

- Monthly overviews to align family spending.

AI Advantage: Excelmatic syncs with bank APIs to auto-categorize transactions, eliminating manual entry.

3. Debt Reduction Tracker

Best for: Paying off loans or credit cards.

Why it works:

- Lists debts with balances/interest rates.

- Visual progress charts for motivation.

Upgrade: Excelmatic’s predictive modeling estimates payoff timelines based on payment adjustments.

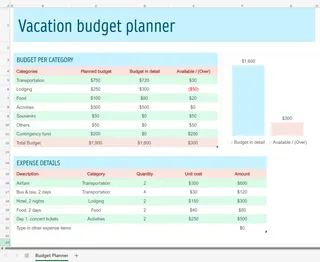

4. Vacation Budget Template

Best for: Planning trips without overspending.

Key functions:

- Allocates funds for flights, hotels, activities.

- Tracks real-time spending during trips.

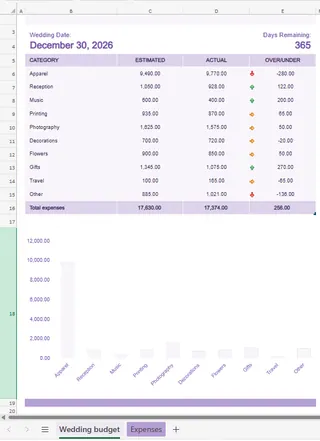

5. Wedding Budget Planner

Best for: Couples managing wedding costs.

Highlights:

- Pre-built categories (venue, catering, attire).

- Tracks deposits vs. final payments.

Why Stop at Templates? AI Does the Heavy Lifting

While these templates are helpful, they rely on manual updates—a bottleneck for businesses. Here’s how Excelmatic elevates budgeting:

- Automated Data Sync: Connect bank accounts, ERPs, or CRMs to pull real-time data.

- AI-Powered Forecasting: Predict cash flow gaps or surpluses using historical trends.

- Anomaly Detection: Get alerts for unusual expenses (e.g., duplicate vendor payments).

Honorable Mentions (Other Free Templates)

- Event Budget Template: For conferences or marketing campaigns.

- Small Business Budget: Tracks revenue, payroll, and operational costs.

- Savings Goal Tracker: Visualizes progress toward targets (e.g., emergency funds).

The Future of Budgeting: AI + Human Oversight

Templates provide a starting point, but AI tools like Excelmatic bridge the gap between data and decisions. Instead of just tracking numbers, you gain:

- Actionable insights (e.g., "Reduce office supply spend by 15%").

- Collaboration features for team-based budgeting.

- Scalability from personal finance to enterprise-level planning.

Ready to upgrade? Try Excelmatic free and turn your budget into a strategic asset.